Transform Your Lending Operations

Streamline loan origination with AI-powered document processing, automated verification, and intelligent risk assessment. Process loans 10x faster while maintaining compliance.

Core Capabilities

Everything you need to originate loans faster

From application to approval, manage the entire lending lifecycle with intelligent automation.

Instant Application Processing

Digital applications with smart field validation and real-time data verification. Reduce manual entry by 90%.

Document Intelligence

AI-powered document extraction and classification. Automatically verify income statements, tax returns, and credit reports.

Risk Assessment Engine

Advanced credit scoring models with alternative data sources. Make faster, more accurate lending decisions.

Borrower Portals

White-label portals for borrowers to track application status, upload documents, and communicate with loan officers.

Compliance Automation

Built-in KYC/AML checks, audit trails, and regulatory reporting. Stay compliant with automatic updates.

Performance Analytics

Real-time insights into pipeline health, conversion rates, and loan officer productivity. Data-driven decisions.

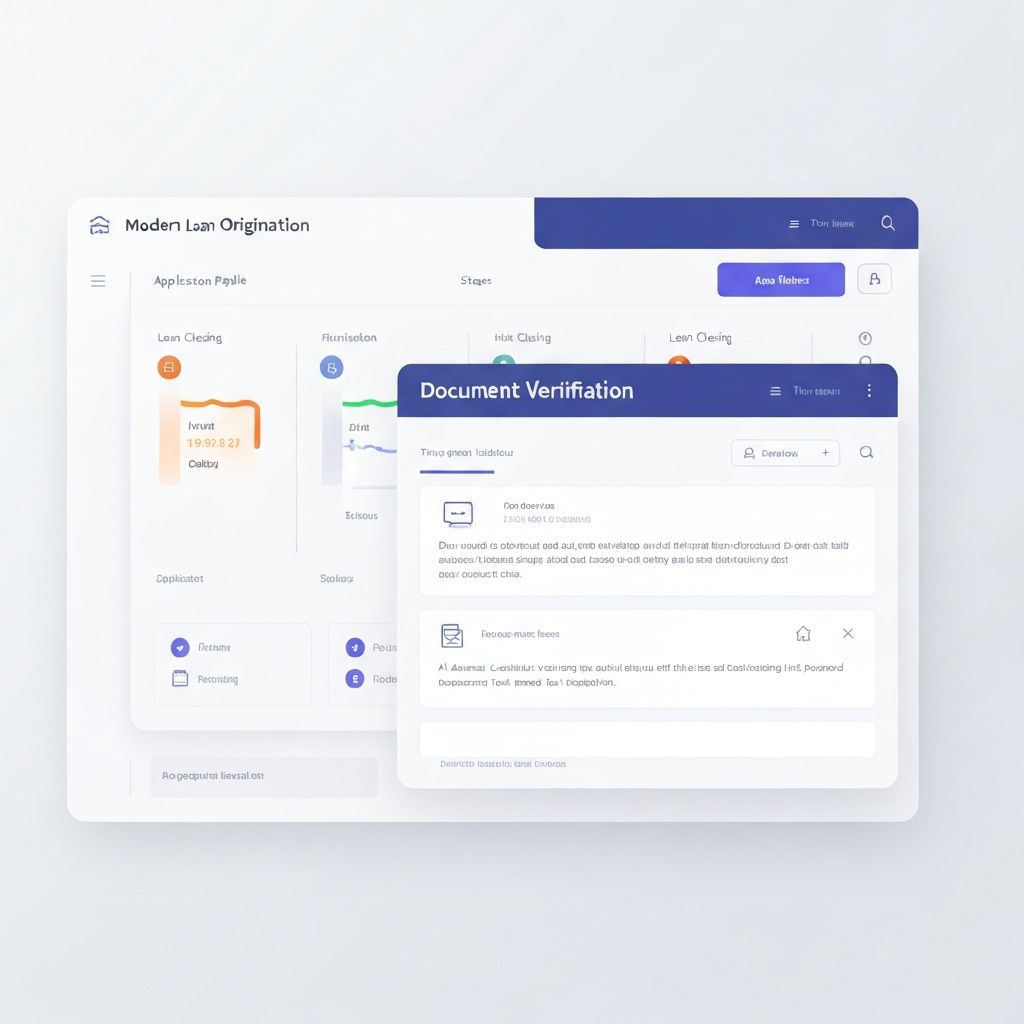

Streamlined Workflow

From application to funding in days, not weeks

Intelligent automation at every step of the lending process.

Application

Digital intake with smart validation

Verification

Automated document processing

Assessment

AI-powered risk scoring

Approval

Instant decision and funding

Ready to modernize your lending operations?

Join leading financial institutions using Finaz.ai to transform their loan origination process.